Flowers may be welcome signs of spring, but a sign that spring is here that may be less welcome is the implementation of the marketplace appeals process for employers. Beginning in 2016, the federally facilitated marketplace (FFM) will send notices to employers if an employee receives APTC and the employee has identified their employer in their application for coverage.

Section 1411 of the ACA requires exchanges to notify employers that an employee has qualified for a premium tax credit for individual coverage through the marketplace. The notice will allow an employer to provide information that the employer has offered coverage to an individual that meets the requirements of the ACA.

Generally, if an employee has an offer of coverage that meets the minimum value and affordability requirements, the employee is not eligible for a subsidy in the exchange. There will be instances in which an employee, nonetheless, could be determined eligible for premium tax credits generally based on household income. But, in many other cases employees could seek exchange coverage because of a misunderstanding of the employer offer of coverage or of the eligibility requirements for APTCs.

The notices will be phased in. Notices will be sent only if the employee received APTC for at least one (1) month in 2016. Each notice will identify the specific employee but will not contain an employee’s personal health information or federal tax information.

An employer will have 90 days to appeal the employer notice. An employer appeal request form can be found at https://www.healthcare.gov/marketplace-appeals/employer-appeals/ . The appeals notice is also used for these state-based marketplaces:

- California

- Colorado

- District of Columbia

- Maryland

- Massachusetts

- New York

- Vermont.

The appeal will allow the employer to claim that the employer has offered the employee coverage that meets the affordability and minimum value requirements. The employer would also indicate whether the employee is already enrolled in the employer’s coverage.

Employers may designate a secondary contact to help with an appeal. The secondary contact may act on the employer’s behalf including communicating directly with the Marketplace Appeals Center.

A successful employer appeal will result in the employee receiving a notice from the FFM instructing the individual to update their marketplace application. The notice will explain the possible tax consequences that the individual may face if they fail to take action.

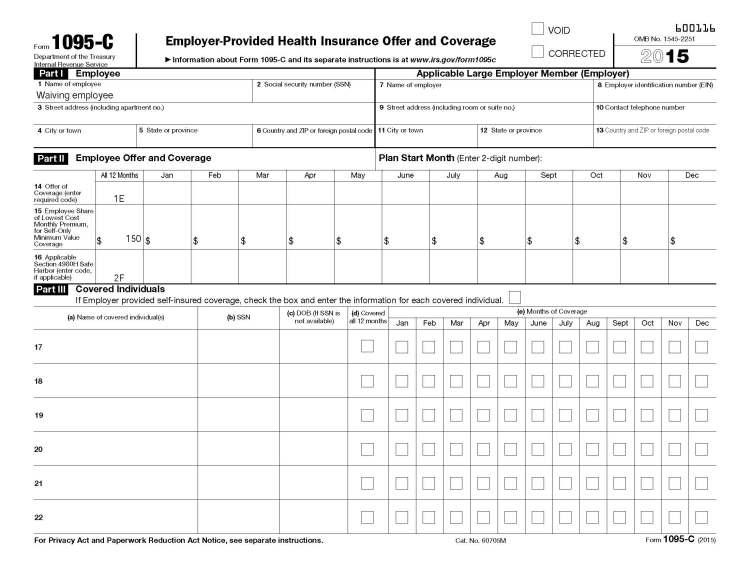

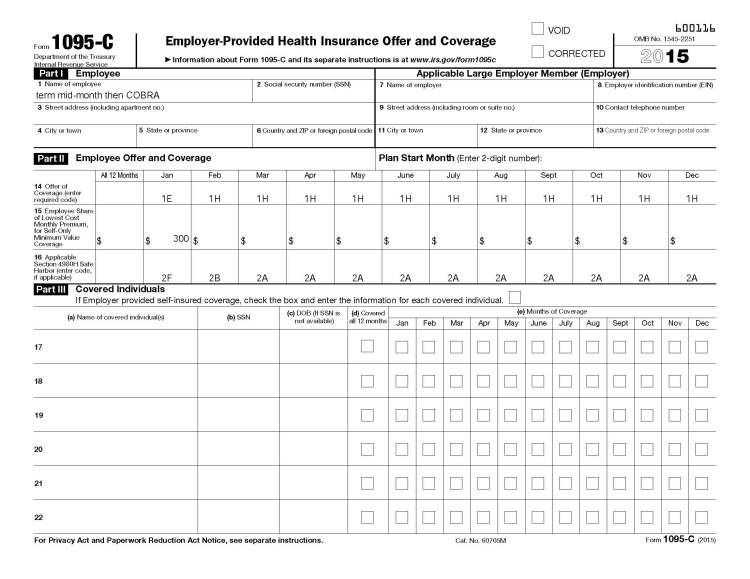

The FFM notice and employer appeal, in and of itself, will not be used to determine whether an employer will face a penalty for the employer shared responsibility provisions. The IRS is expected to rely on the information that is being submitted when an employer files the Form 1094-C and Form 1095-C.

Appeals will be filed to the following address or fax:

Health Insurance Marketplace

Department of Health and Human Services

465 Industrial Blvd.

London, KY 40750-0061

An appeal request may also be faxed to a secure fax line: 1-877-369-0129.

Once an appeal has been filed, a notice will be sent acknowledging receipt of the appeal. The employee will also receive a notice that an appeal has been filed. Once a decision has been determined it will be communicated to both the employer and the employee.

Employers should take immediate steps to identify which individuals in the firm will have the responsibility of responding to the marketplace notices. The intention of the marketplace is to send notices to employers using addresses provided by the marketplace applicant. As such, employers may find that the address an employee used may not be the location designated by the employer to address these notices. So, employers should communicate within the company how they will handle receipt of these notices to ensure that the employer can respond in a timely fashion.